Marcus & Millichap Releases 3rd Quarter 2021 Multifamily Market Report for Philadelphia

Marcus & Millichap’s 3rd Quarter 2021 Multifamily Market Report for the Philadelphia Metro Area has been released. Resiliency has transitioned to near-record growth As of June, vacancy had fallen below the pre-health crisis level. Gains are being driven primarily by suburban neighborhoods, where many households relocated during lockdowns.

Click the link below to view the full report. If you would prefer to view a hard copy of the report, or if you would like to view a report for a market other than Philadelphia, please give us a call at 215-531-7019.

Just Closed: 204-Unit Apartment Community in Southern Delaware Trades Hands

Marcus & Millichap is pleased to announce the sale of Carillon Woods – A 204-unit Class A apartment community in Southern Delaware.

PHILADELPHIA, PA, September 2, 2021 – Marcus & Millichap (NYSE: MMI), a leading commercial real estate brokerage firm specializing in investment sales, financing, research and advisory services, announced today the sale of Carillon Woods, a 204-unit apartment property located in Millsboro, DE, according to Sean Beuche, regional manager of the firm’s Philadelphia office.

Clarke Talone, Andrew Townsend, Ridge MacLaren, William McGlone, and Dan Bernard, investment specialists in Marcus & Millichap’s Philadelphia office, had the exclusive listing to market the property on behalf of the seller, a Delaware-based developer. The buyer, an affiliate of Merion Realty Partners, was secured by Clarke Talone, Andrew Townsend, Ridge MacLaren, William McGlone, and Dan Bernard.

Carillon Woods is located at 34011 Harvard Ave in Millsboro, DE. The 204-unit property is a Class A 2019 construction apartment community located in the strong submarket of Southern Delaware. The excellent location, which is experiencing increased demand as residents leave more dense urban locations, along with rental upside, generated strong buyer activity. The asset closed at 99% of list price.

“The sellers developed a beautiful community in this Sussex County submarket, which is experiencing tremendous growth right now,” said Clarke Talone. “The large units and impressive amenity package helped the property lease up quickly and generate strong rent growth with lease renewals and new leases.”

“Carillon Woods is another example of the heightened demand we have seen for suburban multifamily assets,” added Andrew Townsend. “Our marketing process generated offers from buyers throughout the region looking to grow their portfolio in strong suburban locations such as Millsboro, which offers residents easy access to the beaches, shopping, dining, employment. Merion Realty Partners executed a smooth transaction and are excited to tap into a new submarket”

.

• • •

About Marcus & Millichap (NYSE: MMI)

With over 2,000 investment sales and financing professionals located throughout the United States and Canada, Marcus & Millichap is a leading specialist in commercial real estate investment sales, financing, research and advisory services. Founded in 1971, the firm closed 8,954 transactions in 2020 with a value of approximately $43 billion. Marcus & Millichap has perfected a powerful system for marketing properties that combines investment specialization, local market expertise, the industry’s most comprehensive research, state-of-the-art technology, and relationships with the largest pool of qualified investors. To learn more, please visit: www.MarcusMillichap.com.

Marcus & Millichap Releases 1st Quarter 2021 Multifamily Market Report for Philadelphia

Marcus & Millichap’s 1st Quarter 2021 Multifamily Market Report for the Philadelphia Metro Area has been released. The market continues to demonstrate relative stability through the health crisis, in contrast to most other major East Coast markets, and is positioned to advance even further this year as the economy improves.

Click the link below to view the full report. If you would prefer to view a hard copy of the report, or if you would like to view a report for a market other than Philadelphia, please give us a call at 215-531-7019.

Philadelphia Multifamily Owners Report Strong Rent Collections for April

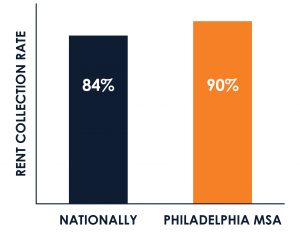

As we speak with apartment owners, we have been pleased to hear that most communities fared well with regard to April collections in the Philadelphia MSA. This week, we conducted a rent collection survey with a number of our clients. Below are the results:

As we speak with apartment owners, we have been pleased to hear that most communities fared well with regard to April collections in the Philadelphia MSA. This week, we conducted a rent collection survey with a number of our clients. Below are the results:

Based on approximately 37,750 units over 285 communities mainly consisting of Class B and C garden-style and urban walk-up, the average collection rate for the month of April to-date is 90%, with a range of 70%-95%.

Additionally, below are a few thoughts and observations we have heard from owners in the marketplace:

- April collections still may improve as the month continues. Especially in C communities, rents are typically slow and may filter in through the latter half of the month. Some owners are hopeful that the arrival of checks from the stimulus program will result in some of the outstanding rent being paid.

- Most owners, pleasantly surprised with the solid April numbers, have now turned their attention to May. With more time elapsed since the stay-at-home orders, owners are concerned about tenants’ ability to pay May’s rent.

- Collections among C properties are generally lower than B properties.

- There are pockets of softness in some communities in Central and Southern New Jersey.

- Numerous owners reported that March collections was their best month on-record, which shows strength in the underlying fundamentals of multifamily in the region.

The Philadelphia MSA is faring better than many other markets in the nation. Per a recent report published by the National Multifamily Housing Council, April collections are currently 84% nationally, as of April 12.

CLICK HERE TO VIEW THE NMHC REPORT

Please reach out to us with questions, or to learn details of the survey. Stay safe!

Ridge, Andrew, Clarke, and Dan

4-13-2020: Special Report | Multifamily Amid COVID-19

Sudden depletion of income streams will create hurdles for renters and owners of multi-family, although unemployment benefits and one-time government payments will help mitigate the impact. Renters are being protected through eviction moratoriums and federally backed mortgage lenders are cushioning borrowers through loan forbearance.

Click here to view the Special Report from Marcus & Millichap Research Services