Marcus & Millichap Releases Quarterly Multifamily Market Report for Philadelphia

Marcus & Millichap’s quarterly Multifamily Market Report for the Philadelphia Metro Area has been released.

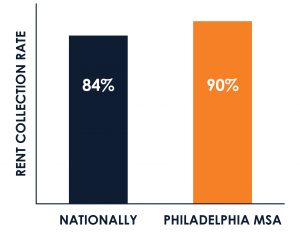

The impact of new supply is concentrated downtown – While deliveries reach a record high this year, placing pressure on vacancy by December, Philadelphia will still maintain one of the lowest rates in the country.

Click the link below to view the full report. If you would prefer to view a hard copy of the report, or if you would like to view a report for a market other than Philadelphia, please give us a call at 215-531-7021.