Philadelphia Multifamily Owners Report Strong Rent Collections for April

As we speak with apartment owners, we have been pleased to hear that most communities fared well with regard to April collections in the Philadelphia MSA. This week, we conducted a rent collection survey with a number of our clients. Below are the results:

As we speak with apartment owners, we have been pleased to hear that most communities fared well with regard to April collections in the Philadelphia MSA. This week, we conducted a rent collection survey with a number of our clients. Below are the results:

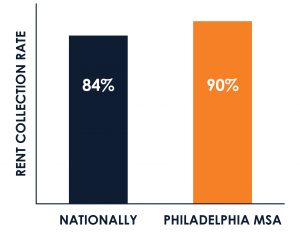

Based on approximately 37,750 units over 285 communities mainly consisting of Class B and C garden-style and urban walk-up, the average collection rate for the month of April to-date is 90%, with a range of 70%-95%.

Additionally, below are a few thoughts and observations we have heard from owners in the marketplace:

- April collections still may improve as the month continues. Especially in C communities, rents are typically slow and may filter in through the latter half of the month. Some owners are hopeful that the arrival of checks from the stimulus program will result in some of the outstanding rent being paid.

- Most owners, pleasantly surprised with the solid April numbers, have now turned their attention to May. With more time elapsed since the stay-at-home orders, owners are concerned about tenants’ ability to pay May’s rent.

- Collections among C properties are generally lower than B properties.

- There are pockets of softness in some communities in Central and Southern New Jersey.

- Numerous owners reported that March collections was their best month on-record, which shows strength in the underlying fundamentals of multifamily in the region.

The Philadelphia MSA is faring better than many other markets in the nation. Per a recent report published by the National Multifamily Housing Council, April collections are currently 84% nationally, as of April 12.

CLICK HERE TO VIEW THE NMHC REPORT

Please reach out to us with questions, or to learn details of the survey. Stay safe!

Ridge, Andrew, Clarke, and Dan